Purchasing goods and services or their trading requires some form of exchange. These forms of exchange have evolved, which is how the birth of crypto came to be.

But many of us have only heard about crypto because of the thoughts and strategies about it that have been spreading fast. Still, a large number cannot explain what crypto is all about. If this sounds like you, this article is for you. Read on to find out the basics.

What is Crypto?

Crypto, the common cryptocurrency abbreviation, is a form of decentralized digital currency usable for online exchange. It employs the use of cryptography to ensure transaction verification and security and also for the creation control of new digital currency units.

Cryptocurrencies are distinguished from fiat currencies like USD or Pound since no central authority issues them. For this reason, they are potentially impenetrable by government manipulation or intervention.

How Cryptocurrency Functions

Many cryptocurrencies work through and are supported by blockchain technology. Disseminated computer networks enforce this distributed ledger technology to maintain fraud-proof transaction records and manage/keep track of crypto owners.

The development of this technology sorted out an issue about creating purely digital currencies; people could hence not make copies of their holdings and attempt to utilize them numerously.

There are individual crypto units, and depending on their use, they are termed coins or tokens. Some serve as exchange units for goods and services, while others are employed in software apps or programs for financial products and games. Some are used as value stores.

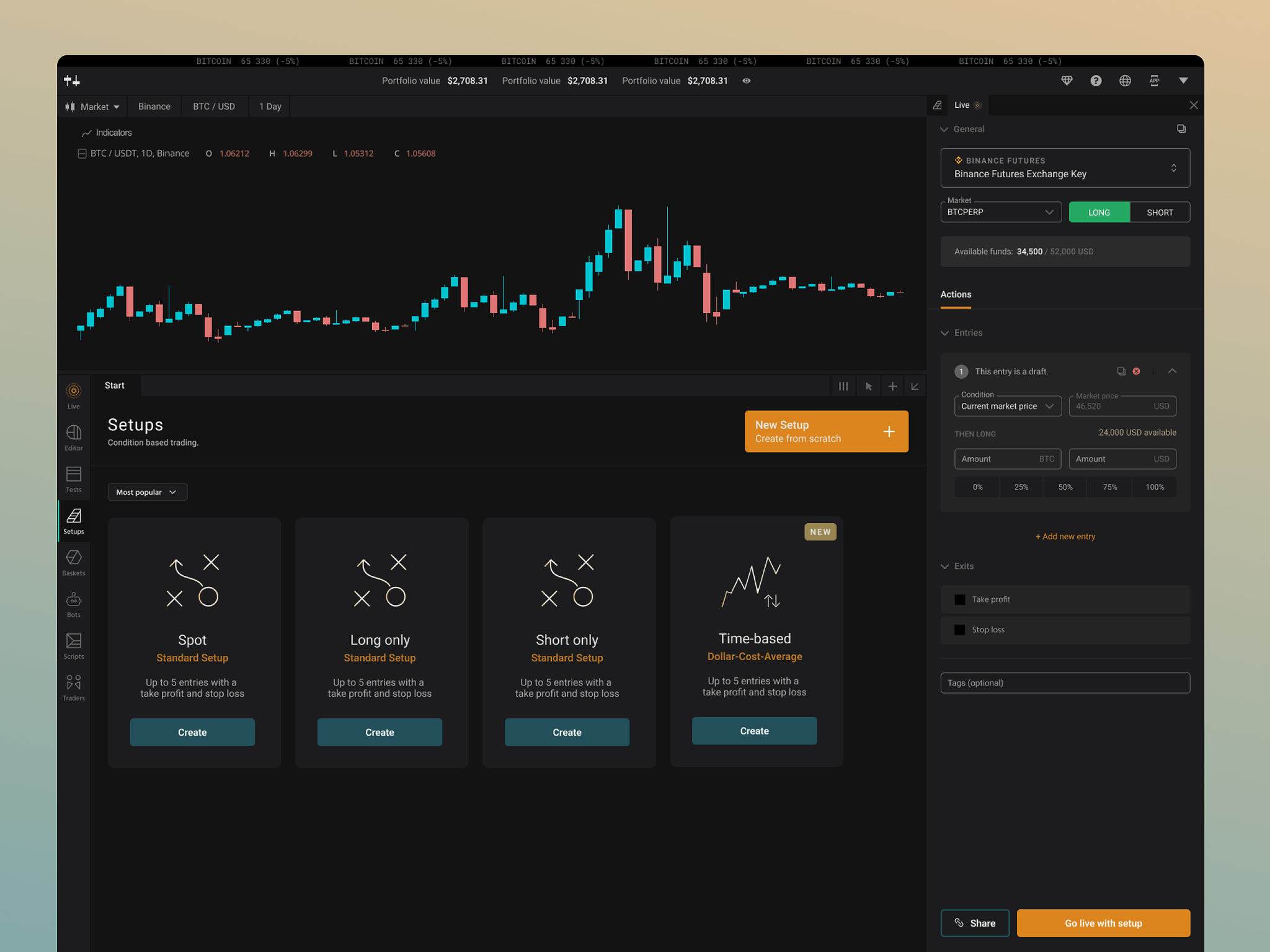

How to Purchase Cryptocurrency

The most accessible way to attain cryptocurrency is through broker purchase or user exchange. You must create an account, put in cash, and buy/place your trade order. If you mainly seek crypto exposure, you can buy an ETF( Exchange Traded Fund), own a cryptocurrency company’s stock, or purchase a crypto-focused mutual fund.

Cryptocurrency Forms and Their Value

Today, there are millions of cryptocurrencies, and they differ in value. Bitcoin has the largest market capitalization/size and was the earliest form of cryptocurrency to penetrate the market. Many others, such as Ethereum, Cardano, Solana, and Tether, have come up today.

Estimating the total cryptocurrency market size is difficult since cryptocurrencies do not have official data sources like public equities markets. Some cryptocurrencies are also unknown, making them worthless.

If you want to get into cryptocurrency, it is advisable to begin with a renowned and commonly traded one—fundamentally, with substantial market capitalization.

Investing in Crypto

The main drive behind investing in crypto is the hope that it will be valuable and profitable. You can think of cryptocurrency investment(s) in various spectrums.

Some cryptocurrencies, like Bitcoin, are perceived to have money-like qualities. i.e., they are units of account, can store value, and can be used as mediums of exchange. If you are a Bitcoin enthusiast, you may favor it as an improved monetary system and instead use it for everyday transactions.

Other cryptocurrencies are regarded as asset classes for investments, like stocks, whereby they potentially offer high return levels.

With that said, intentionally choosing a specific crypto is not always a guarantee that it will be a success. The crypto space is highly volatile. Sometimes, an issue in an interrelated crypto industry issue may come out and bring profound asset value implications or losses.

Generally, whether a particular crypto is a good investment depends on your profile as an investor.

Cryptocurrency and Financial Security

Many people looking to invest in cryptocurrency often wonder whether it is or is not a financial security, like stocks. This is still vaguely defined.

For a bit of understanding, a ‘financial security’ constitutes anything that depicts value and is tradeable. A stock is a financial security as it represents a public company’s ownership. A bond is also a security since it is regarded as a debt owed to a bondholder. Both stocks and bonds are tradeable in public markets.

Even though regulators are for the idea that cryptocurrencies should be governed like other securities, there has been a lot of pushback against the same, citing that many rules applicable to bonds and stocks are irrelevant to cryptocurrencies.

Cryptocurrency Regulations

The rules governing cryptocurrency are still being derived. More focus is put into whether a specific cryptocurrency is within the legal description of ‘security.’ i.e., it is subject to the registration and disclosure necessities of the Securities and Exchange Commission.

Mainly, cryptocurrency policymakers focus on the governance of cryptocurrencies attached to stable assets, or stablecoins, and cryptocurrency trade exchange regulations.

Tax treatment, Decentralized Autonomous Organizations (DAOs), and anti-money laundering necessities are progressing legal issues about cryptocurrencies.

Pros of Cryptocurrency

- With cryptocurrency, you can transfer value online without needing a principal counterparty like a bank. You can also do fast global value transfers anywhere at any time.

- Many traders consider crypto as a higher-ranking form of value transfer. Because it employs blockchain technology, it provides some benefits traditional money and payment systems may not—e.g., Security, privacy, and irreversibility.

- There are cryptocurrencies that give owners a favorable opportunity to obtain passive income from staking. Staking in crypto means using cryptocurrencies for transaction verification on a blockchain protocol. It may pose some risks but can help you increase your crypto holdings without purchasing more.

Cons of Cryptocurrency

- Since the prices of cryptocurrencies tend to change quickly, short-term crypto investors may run some risks. Even though the rapid price change may mean making money faster, some people have also had to lose just as quickly.

- Numerous cryptocurrency projects have not yet been thoroughly tested, and blockchain technology is yet to be widely adopted. Assuming that the idea behind cryptocurrency does not fully materialize, long-term investors may not get the hoped-for returns.

- The significant value shifts of cryptocurrencies may cut against the ideas birthing the projects meant to be supported by cryptocurrencies. For instance, many are less likely to utilize Bitcoin for payment if they are unsure what its worth might be after a day.

- Worldwide governments are not yet fully versed in cryptocurrency governance. Because of this reason, some crackdowns and regulatory changes may affect markets in unforeseen ways.

Are Non-Fungible Tokens (NFTs) Cryptocurrencies?

Like cryptocurrencies, NFTs are tradeable digital assets. They, however, primarily convey ownership of what may be regarded as a digital file’s original copy.

NFTs vary from cryptocurrencies due to their name’s clunky term: non-fungible.

Contrary to NFTs, cryptocurrencies are defined as fungible, meaning that a particular cryptocurrency unit is equally the same as another regarding value.

Final Thoughts

The bottom line is that cryptocurrency has been a game changer for investors and businesses and offers a future for trade. However, as a beginner, you may find the understanding of cryptocurrency overwhelming. We hope that with this article, we have broken down crucial details for you.

Generally, owing to the uncertainty and volatility of the crypto industry, if you are looking to invest, it is best that you talk to a financial advisor, follow fundamental rules for good investing, do your research to find a trusted cryptocurrency exchange, and steer away from investments offering irrational returns.