The dynamic world of cryptocurrencies has been evolving with new, attractive discoveries. One such discovery that has revolutionized the way traders transact cryptocurrencies is Automated Market Makers or AMMs. It may be a new term for many beginners, but it has already become a prominent protocol for several traders.

In this comprehensive guide, let us unravel the mysteries of AMMs, explaining what they are and how they work. Whether you are a novice in the crypto world or simply willing to gain knowledge, this guide will give you valuable insights to comprehend this essential aspect of Decentralized Finance (DeFi).

What Is an AMM?

An Automated Market Maker (AMM) refers to a key feature of DeFi platforms and Decentralized Exchanges (DEXs). It is decentralized exchange protocol utilizing smart contracts and algorithms for trading cryptocurrencies without any customary intermediary such as a bank or a broker.

No longer one needs to depend on centralized exchanges to match the trade with that of someone else. Smart contracts form liquidity pools where the parties can quickly exchange tokens. In these pools, the pricing of assets is determined by mathematical algorithms, paving a simple way to trade.

The protocol automates the process of trading these currencies directly with each other on a blockchain network, making the process more accessible and efficient. Being integral to DeFi platforms, AMMs are widely used for liquidity provision and trading. Apart from the decentralized structure, they ensure 24/7 availability and accessibility, thus becoming a popular choice of several cryptocurrency investors.

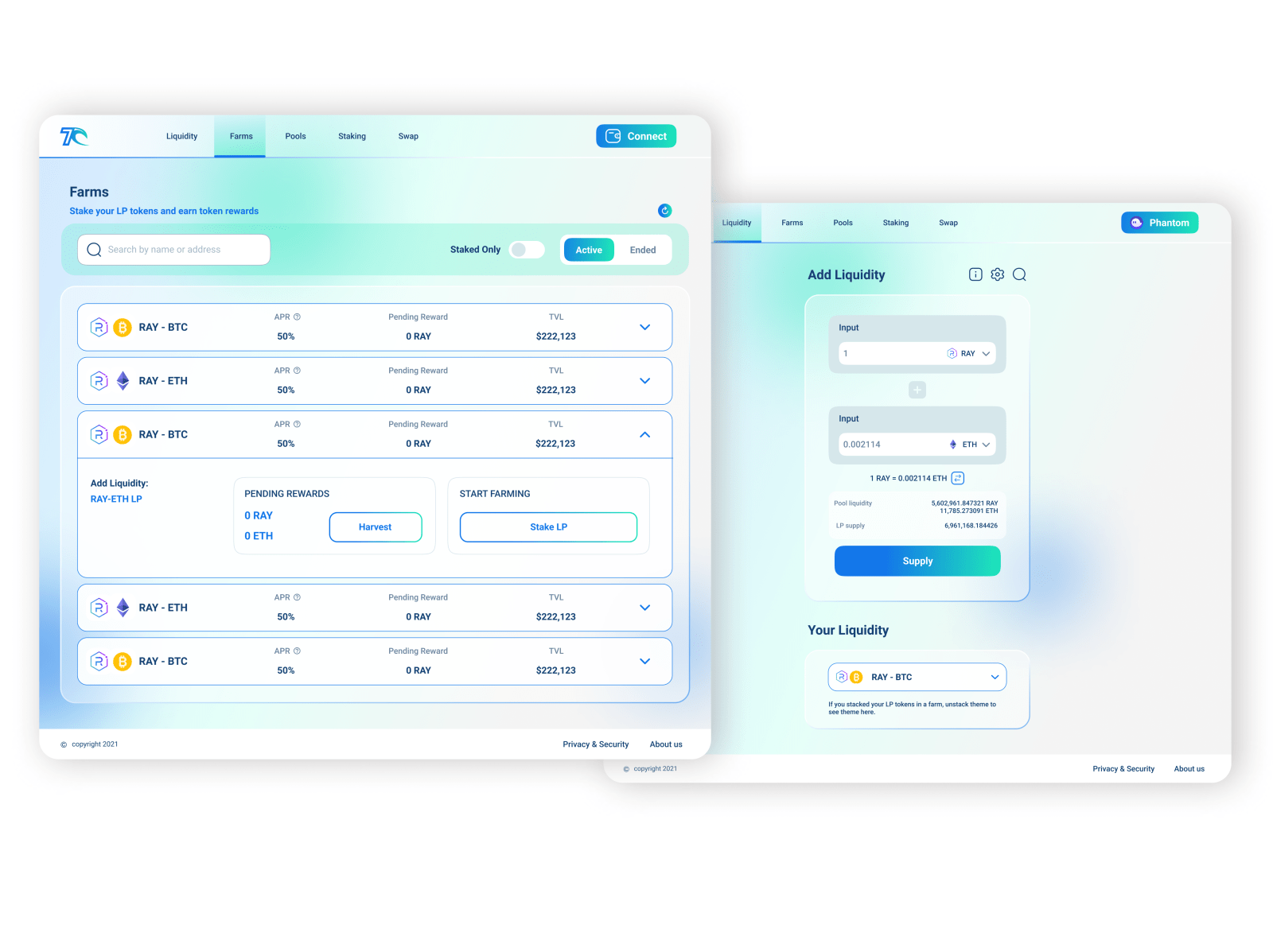

What Are Liquidity Pools?

At the foundation of AMMs are liquidity pools, an assortment of crypto assets used for trading. Those who deposit their assets in these pools are called Liquidity Providers (LPs).

Prior to AMMs, for decentralized exchanges (DEXs), liquidity was limited. Due to the complicated interface and new technology involved, the number of parties to sell and buy was few. Thus, it became tough to find adequate people who wished to trade regularly.

AMMs addressed this issue of limited liquidity by forming liquidity pools and offering liquidity providers a chance to supply assets to these pools. The underlying notion here is: More assets in a pool means more liquidity the pool has and simpler the trading on decentralized exchanges.

Thus, liquidity is indispensable for the smooth functioning of AMMs. In the absence of enough liquidity pool for an AMM, a big price impact becomes inevitable during the trade on the DeFi AMM, leading to capital inadequacy and transient loss.

To incentivize liquidity providers to keep their assets in the pool, AMMs pays them a fraction of the AMM-generated fees. This is typically allotted as LP tokens. Depositing assets to get this reward is called yield farming.

The prices of assets automatically vary as per the demand. For instance, a liquidity pool could hold 20 million dollars of each USDC and ETH. A trader could then swap 200k dollars’ worth of own USDC for ETH, which would increase the price of ETH.

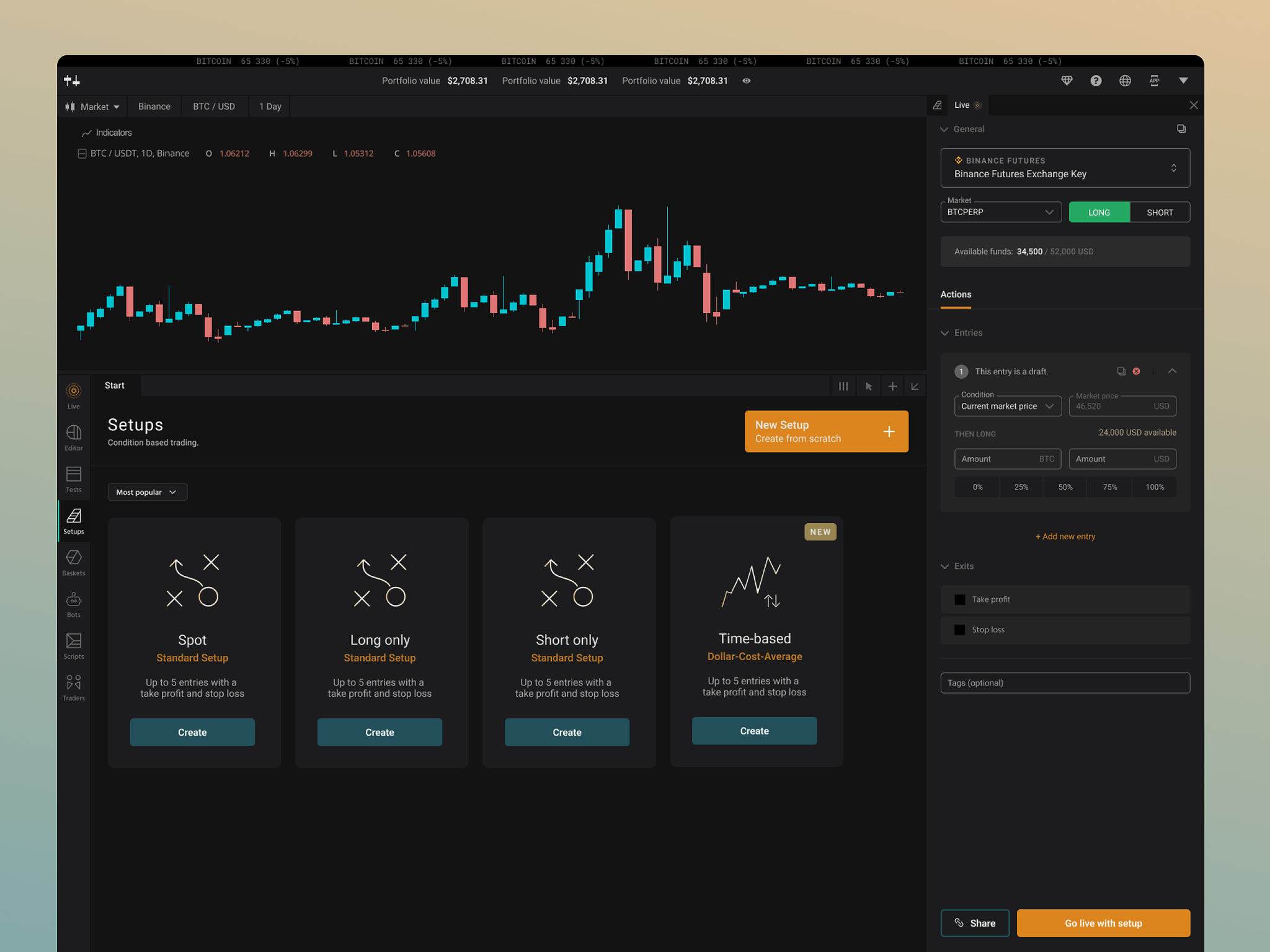

How Does an AMM Function?

Comprehending how an AMM functions requires knowing the key components of the process, which are as follows:

- Liquidity Pools: These pools are a collection of funds, which typically consists of two different cryptocurrencies to which traders contribute. Yes, it will have a pair of cryptocurrency assets. For instance, a liquidity pool may contain Ethereum (ETH) and a stablecoin such as DAI. Users deposit both in the pool.

- Automated Pricing Algorithm: AMMs use a preset mathematical algorithm to compute the price of assets in the pool. One of the most common algorithms used is the Constant Product Market Maker formula as x*y=k. Here, k is a constant value, ensuring that the product of the quantities of both assets is always the same. The formula helps in determining the price based on the ratio of pool’s tokens.

- Trading and Swapping: A trade is initiated by swapping one asset for another in the liquidity pool. When this trade is made, the pricing algorithm adjusts the quantities in the pool to share a new exchange rate to maintain a constant product (as per the formula). Essentially, the pool ensures that every trade has a corresponding buyer or seller.

- Fees and Rewards: AMMs usually charge a small fee per trade, which is given to liquidity providers to encourage their contribution. It acts as an incentive to provide liquidity to the pools. In return, LPs earn a part of these fees in the form of additional tokens.

What Are the Advantages of AMMs?

Now that you have a basic understanding of what AMMs are and how they function, let’s explore the advantages they offer in the crypto world. Here are these advantages:

- Accessible; AMMs are open to anyone who has a cryptocurrency wallet, making themselves more accessible than traditional exchanges demanding registration and identity verification.

- 24/7 operation; AMMs allow users to trade at any time, even on holidays, without putting any of the restrictions of traditional markets.

- Liquidity provision and less slippage; due to liquidity pools, there is always an assurance of a source of liquidity for trading. As a result, the risk of slippage is minimized, and the crypto trades can happen quickly. Slippage refers to the difference between the expected and executed price of a trade.

- No intermediaries due to decentralization operation on blockchain networks.

- Innovation; the flexibility of algorithms has facilitated different DeFi innovations, including yield farming and decentralized lending and borrowing.

Are There Any Challenges or Risks?

Yes! While AMMs have their benefits, they are not free from challenges or risks. These challenges are as follows:

- Limited asset pairs; not suitable for less common or more illiquid tokens

- Impermanent loss for liquidity providers, eroding their potential gains if the change in price is significant

- Price inaccuracy to some extent in some situations, such as large trades

- Regulatory environment; evolving for DeFi and AMMs and now having legal and tax implications

Conclusion

AMMs play a critical role in remodeling the process of trading cryptocurrency by offering decentralized, efficient, and accessible solutions. However, while there are many benefits of AMMs, they come with risks. It is important to consider your risk tolerance level before stepping into AMMs.